Auctions. Auctions. Auctions

Was the latest renewable energy auction really a good deal for British consumers? Depends on who you ask.

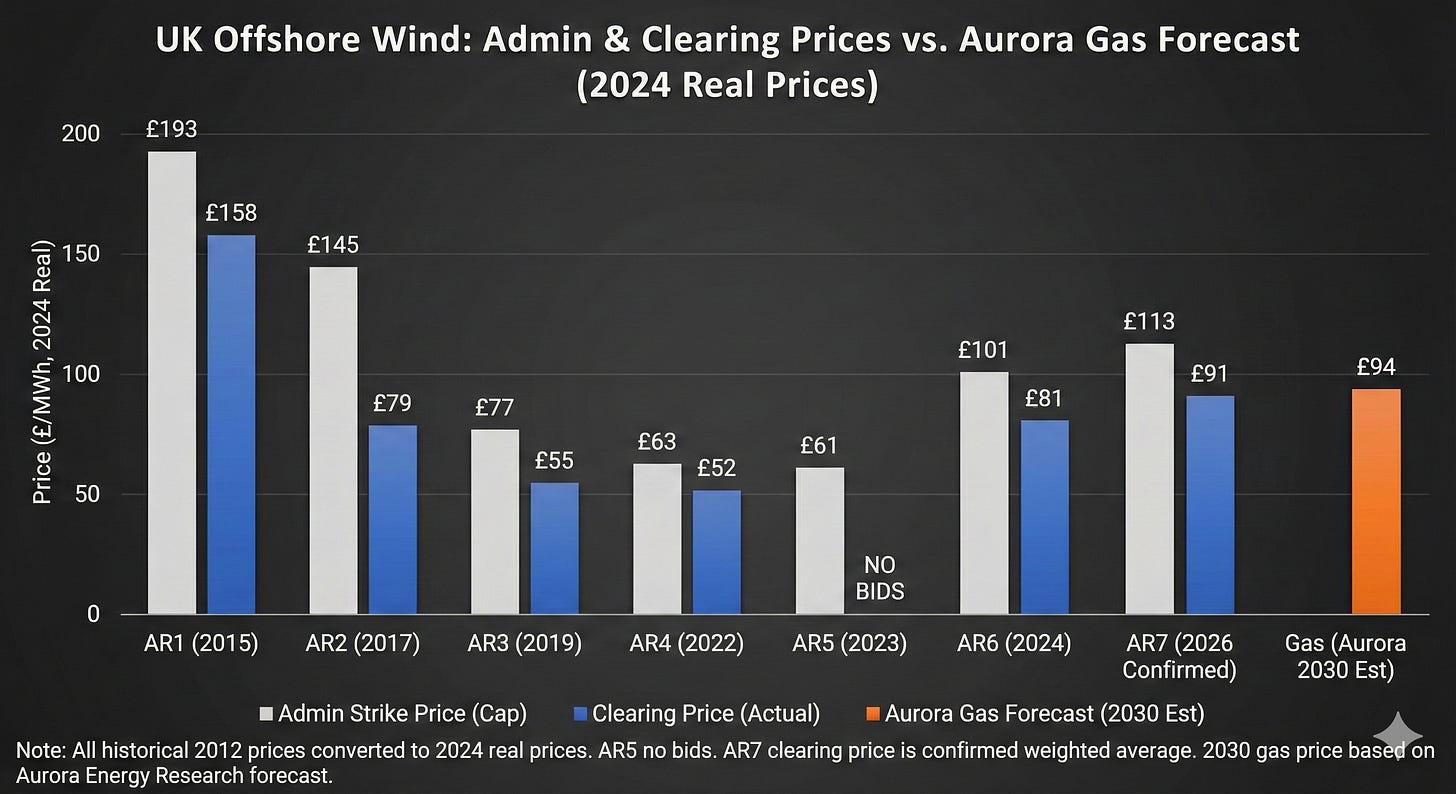

Britain just bought a huge amount of offshore wind farms, 8.4 GW to be precise, to power the country over the next three decades. Clean power, particularly through offshore wind, is the only way to secure long term energy security for the country, I am convinced of that fact. But the real question, given the state of the economy, is at what cost? Yesterday’s results came in at ‘strike price’ of £91.2 / MWh. As shown in the graph below, it is safe to say that Offshore wind is no longer ‘cheap’ and just about competitive with gas. More on this below but I want to reflect briefly on the nature of the debate around these prices which grabbed my interest.

Medium as the message

As soon as the results dropped, two parallel universes emerged. One hailed this as a victory and another derided it as a sell out. Predictably, one was playing out on bluesky and LinkedIn while the other, more vociferous and damning, was on X. Such a division of opinion shouldn’t come as a surprise to us given the state of political and cultural debate on the internet but I found it jarring nonetheless to see this over a highly technical energy policy matter. The Bsky gang would venture onto X to proclaim the naysayers are misusing figures and the latter would hit back with their own figures. Ed Miliband, the secretary of state for energy, is often the primary target for some disgusting vitriol on X.

It is important to acknowledge the role of AI models in intermediating these debates online. It is very easy for anybody with an opinion to now reinforce that with clever sounding technical arguments provided by Grok or chatgpt. Given how quickly these tools have proliferated, it’s not a surprise that the echo chambers have intensified and the winner, if there’s such a thing, will often be the loudest. So I fear that even the once dry, technical realm of energy policy is dragged into the culture wars. As the famous saying from Marshall McLuhan’s goes, “the medium is the message”. In the context of AI, it is becoming increasingly easy to act without much understanding because the fluency of AI responses is enough to embolden the amateur or uninitiated to claim expertise. I have no idea how one contends with this new reality but suffice it to say, democratic policy making just got a lot more difficult and I sympathise with policy makers.

A good deal or a bad deal?

Now lets look at the brass tacks. For this to be a good deal for British consumers, I’d test it against the energy trilemma - affordability, security, sustainability. On the sustainability front - the scale of wind capacity and the clean power mission will simply drive gas and other thermal capacity to the edges of the energy system. They latter will remain critical but operate for far fewer hours in a year than they currently are. If we build the capacity this government is aiming for, the UK’s electricity grid, for a major economy, will be one of the cleanest in the world (~35grams of CO2/kWh). That is no mean feat and the government + the system planners will deserve a lot of credit. On the security front too, this auction and the clean power mission will make Britain a lot more secure in the long run. Energy is the bedrock of any society and if you can generate your own without relying on potentially hostile powers, you are creating the foundations of a more stable economy. That is why America, for instance, is wholly energy independent nation, albeit powered on fossil fuels.

We are two for two, so it’s looking good for the govt. However, on the affordability question - the jury is very much out and I unfortunately find it hard to believe friends who welcomed yesterday’s results. I have 3 main concerns:

Comparisons to gas - I do believe it is disingenous to compare these new offshore wind prices against new build gas power plants, with even ministers wrongly claiming that the later would cost £147/MWh (this assumes a new CCGT plant built to operate at 30% load factor, or a peaker plant). The department’s own central estimate puts it at £109/MWh with carbon tax for a plant operating at 90% load factor. It doesn’t help with public discourse when one is cherry picking figures to suit one’s narrative - we are effectively copying the opposition’s playbook and I doubt that works. A fairer comparison would be against the short run marginal cost (SRMC) of gas i.e. the operational costs which is ~£86/MWh (£45 fuel and £41 carbon). Compared to that, yesterday’s procured price was relatively high. A lot of this wind will effectively displace gas which is another reason to compare the price against the SRMC. In other words, the only gas plants we will build are to backup wind, so the same cost of construction is spread across fewer MWh’s, thereby increase the £/MWh. I see the comparison with the higher figure as intellectually dishonest.

Comparisons to AR6 - I cannot get over the fact that despite a 20 year contract - which many think tanks and the renewables lobby argued for - and additional sops such as the clean industry bonus, the price is still 11% higher than the results from the previous auction, AR6. The reality that supply chains are crunched and capital costs are high isn’t an excuse for procuring your largest chunk of offshore wind at a very high price. We could either have procured less, not bought anything at all or made specific reforms to the CfD which I discuss below. Is this an unfortunate case of targetism over cost effectiveness?

Dealing with intermittancy over decades - I am not going to echo the tiring narrative that renewables are not reliable because the sun doesn’t always shine and the wind doesn’t always blow. We get that! However, yesterday’s purchase will also carry an intermittancy/balancing cost on top of it (~£10/MWh according to some estimates). We just cannot ignore that. We are looking at developers securing guaranteed revenues that could index up to £150/MWh by the late 2030s (based on a 2% CPI index). For a mature technology, that is an extraordinary yield.

Aurora and Baringa’s reports

At the heart of the response from my friends has been to cite the reports from reputable consultancies, Aurora energy research and Baringa. I’ve relied on their work several times in the past but without putting my tin foil hat one, I find it peculiar that both those reports were effectively commissioned by the winners of yesterday’s auctions. RWE, Aurora’s client, effectively bought the auction by winning 80% of the contracts and one of their projects, Dogger Bank South is a joint venture with Masdar, Baringa’s client. These reports carry a fairly standard boilerplate text at the end that effectively states that their work is for their clients and clients alone and other users should exercise caution in using their numbers. This of course doesn’t reduce the quality of their research but I’m disappointed that many have casually used those numbers to back their arguments. I have 3 more concerns with their reports:

Wholesale price effects - thanks to the merit order effect and the zero marginal cost of solar and wind, renewables have a depressing effect on wholesale prices. That is why we see negative prices in markets like Germany and Australia where free energy effectively takes the whole market price down with them. This is fantastic for consumers and Aurora assumes that this effect and the consequent impact on bills will offset the rise in CfD payments to developers. So far so good. But when you are moving into a market where fixed price, CfD linked projects combined with capacity market projects dominate the system, wholesale price becomes increasingly irrelevant. Their report states, “By 2035, CfD levies double but are offset by a 5% drop in wholesale costs and reduced Capacity Market

costs (1GW fewer CCGTs) compared to No Additional Wind”. So the counterfactual is a scenario with ‘no additional wind’ which is also unrealistic.

Rising gas price - both reports make assumptions about rising gas prices. In fact, their collective claim that any strike price below £94/MWh is cost neutral to consumers relies heavily on gas prices rising. Offshore wind is the best hedge against gas volatility, I am convinced of that, but is it justified to commit to a 20 year contract with a developer based on a hunch that gas prices will rise and consequently your CfD investments will look more attractive? I remain unconvinced. Most analysts show that prices will remain stable or fall for the remainder of the decade. Some analysts (like the IEA) forecast an LNG glut that could crash gas prices to ~50p/therm by 2030.

I am not for a moment suggesting that we continue to rely on gas but I just cannot get over the fact that we’ve signed 20 year contracts based on this highly volatile assumption. Perhaps the economic growth and higher productivity this government is promising will make us all rich and make these costs look puny but I am not prepared to make that bet. Baringa’s counterfactual is the 2022 gas price shock. It’s fair to do so as one scenario but it cannot be the only scenario. I do believe civil servants looked at a variety of reports and inputs but its disconcerting to see colleagues not look at these reports with a more sceptical eye.Transmission build out - Aurora’s model assumes that transmission network capacity expands by an average of 3 GW per year until 2035. I applaud the government’s efforts to scale up transmission capacity as this is long term infrastructure that we need but Aurora’s assumptions are quite reliant on this network avoiding the huge constraint payments that developers have benefited from in the past few years - to the tune of billions every year. We are trying to fix this problem but again, I find it hard to accept a strike price that assumes this backbone infrastructure will be in place to significantly mitigate curtailment costs.

I also found in distasteful to note the remarks made by the head of RWE when he suggested that we spend too much time worrying about affordability when security and decarbonisation mattered more. During a cost of living crisis, this is tone deaf at best.

Furthermore, a lot of these projects in AR7 and the subsequent AR8 and 9 will only be operational in the early 2030s. So its safe to say that the mission is clean power early 2030s! (not a complaint as even this is a herculean task!)

It’s the cost of capital, silly

Interest rates have gone up and so has the cost of capital for developers. With equity rates over 10-12% and debt around 7-8%, the weighted average cost of capital can be as high as 8-10%. This is considerably high compared to the previous auction rounds. Cost of capital is a considerably large component of developer costs. For example, “a lower WACC of 4% reduces the total offshore wind project costs by about 30% compared to the costs derived from the standard WACC of 8%.”

One of the changes the government could have introduced for AR7 is to find ways of reducing the cost of capital for developers. A 1% reduction in WACC could see strike prices come down by as much as £10/MWh. This is significant in the context of the government procuring such large amounts of renewables. How do we achieve that? Well, for starters, the National Wealth Fund, alongside the public finance ecosystem in the UK, including the UK Export Finance and the British Business Bank could step in an offer guarantees or concessional loans for the construction phase of the projects (the 5-7 year period which carries the most risk and the highest risk premium). Alternatively, the Bank of England could use its term funding scheme to channel cheaper credit to commercial lenders to pass on to developers. The latter is less palatable to the Bank but the NWF has the capabilities but not a clear mandate from HMT to undertake this exercise.

It appears critical that we at least put this in place for AR8 where we are set to again procure a relatively large amount of offshore wind.

Shall we scrap CfD’s?

Has this scheme run its course? Inflation index fixed term contracts for a mature technology such as offshore wind appears anathema to me. In a race to net zero, we should not forget to zoom out and question whether the current policy design is even fit for purpose. I’d personally like GB energy to build some capacity fast and start developing its own projects, through majority stakeholdership for instance. Miliband’s words still echo in my head when he said pre elections that all our riches from wind go to foreign governments and peoples. It’s no different with yesterday’s results with the German municipalities and private hedge funds like Blackrock that will benefit from a steady income source via British consumers’ pockets. GB energy was set up with a vision to undo that set up but its turned into a measly financing institution!

Given the rate at which we are building the transmission infrastructure, we need to see more direct PPAs between developers and offtakers and we should also explore large public offtakers (a retail arm of GB energy if you will). We need a lot more focus on distributed energy resources as the local power plan seems to be languishing somewhere in Whitehall. I doubt the government will scrap AR8 and by the end of it, there’s a good chance that we will be on our way to at least 85% clean power. That is a genuine cause for celebration but like with most Labour’s policies, it will likely leave them with more pain than gain at the polls.

What next?

I’m running out of steam here but let me leave with this. It is self evident to me that my colleagues and I have lost the argument on renewables. For over a decade we said renewables were cheap but if only … XYZ<insert your favourite excuse> was in place, we wouldn’t be in the rut that we find ourselves in. Clean power is the only way out of this mess, that is certain, but our existing policy approach has clearly not worked and that is why we are on the backfoot. We can argue and debate all we want with bad faith actors on X over misuse of figures, the fact that the public do not see the benefits and unfortunately won’t for the foreseeable future (unless another price shock happens of course), puts us in a very weak position. Welcoming yesterday’s announcement on affordability grounds while quickly shifting to arguing about how to shift policy levies off electricity bills is rather depressing to watch but that is precisely what many of us will do.

A strategic slow down to net zero isn’t a bad thing if that affords you more space to win your arguments. Alternatively, you show a Thatcherite resolve to see through your plans no matter what and this Prime Minister and his government have shown no such mettle.